Fixed Deposit Alternatives That Offer Better Returns for Sophisticated Investors

For sophisticated investors in Singapore, the traditional fixed deposit has become a tool for capital preservation, not growth. With FD rates struggling to outpace inflation, parking significant capital in these instruments results in a gradual erosion of purchasing power. The search for yield has become imperative.

This guide is not about speculative gambles. It is a strategic overview of legitimate, institutional-grade fixed deposit alternatives that offer superior risk-adjusted returns for accredited investors and high-net-worth individuals who understand how to navigate beyond the bank counter.

The Fixed Deposit Dilemma: Safety at a Cost

Singapore fixed deposits offer capital protection (up to SDIC limits) and predictability. However, in the current environment, they present two critical problems for serious investors:

Negative Real Returns: With headline FD rates around 2.0% - 3.5% and core inflation persistent, the post-inflation ("real") return is often negligible or negative.

Opportunity Cost: The capital locked in an FD is not deployed into assets that can generate meaningful wealth appreciation or compound at a rate that meets long-term financial goals.

"A fixed deposit is a financial parking lot. Sophisticated investors don't park; they fuel their journey toward financial destinations."

Tiered Alternatives: Matching Alternatives to Investor Sophistication

The spectrum of "what is better than fixed deposit" ranges from slightly more complex to fully alternative. The right choice depends on your risk tolerance, liquidity needs, and accreditation status.

Tier 1: Enhanced Public Market Liquidity (For the Cautious Transition)

These options offer slightly better returns than FDs while maintaining high liquidity.

Singapore Savings Bonds (SSBs) & Treasury Bills: Government-backed, offer comparable or slightly better rates than FDs with more flexibility. Best for: Direct FD replacement for safety-first capital.

High-Quality Corporate Bond Funds: Diversified funds investing in investment-grade corporate debt. Potential Return: 3.5% - 5.5% p.a. Best for: Investors comfortable with minor credit risk for a modest yield pickup.

Money Market Funds & SGD Cash Funds: Ultra-short duration funds. Use a Cash Fund calculator to compare projected yields against your bank's FD rate. Best for: Parking funds earmarked for near-term opportunities while earning a competitive yield.

Tier 2: Private Credit & Direct Lending (The Core Alternative for Yield)

This is where sophisticated investors truly replace the function of an FD (income generation) with a structurally superior asset.

The Investment: Providing loans directly to established small and medium-sized enterprises (SMEs) or through curated private credit funds.

The Mechanism: You become the bank, earning the interest spread.

Why it's Compelling:

Yield: 8% - 12% p.a., significantly higher than any bank FD.

Security: Often senior-secured, with assets as collateral.

Structure: Floating rates can provide a hedge against rising interest rates.

Best for: Accredited Investors seeking substantial yield enhancement without equity market volatility. This is the definitive answer to "What is the safest investment with the highest return?" in the private debt space.

Tier 3: Structured Notes with Capital Protection (The Tailored Solution)

For those who ask, "Is 30% return on investment possible?" — yes, but not sustainably or safely. Structured notes offer a middle ground.

The Investment: A bank-issued instrument that links returns to an asset's performance (e.g., a stock index) while protecting a portion of the principal (e.g., 90%).

The Mechanism: You might earn 70-80% of the upside of the S&P 500 over 3 years, with 90% of your capital guaranteed at maturity.

Potential Return: Variable, but target 6% - 15% p.a. depending on structure and market performance.

Best for: Investors seeking defined downside risk with participation in market upside, moving beyond the fixed return of an FD.

Tier 4: Real Asset Debt & Infrastructure (The Inflation Hedge)

Investing in the debt backing essential assets—logistics warehouses, data centers, renewable energy projects.

The Investment: Lending to projects with long-term, contracted cash flows.

Why it's Compelling: Returns are often indexed to inflation, and the underlying asset provides tangible security.

Potential Return: 7% - 10% p.a.

Best for: Building a durable, inflation-resistant income stream.

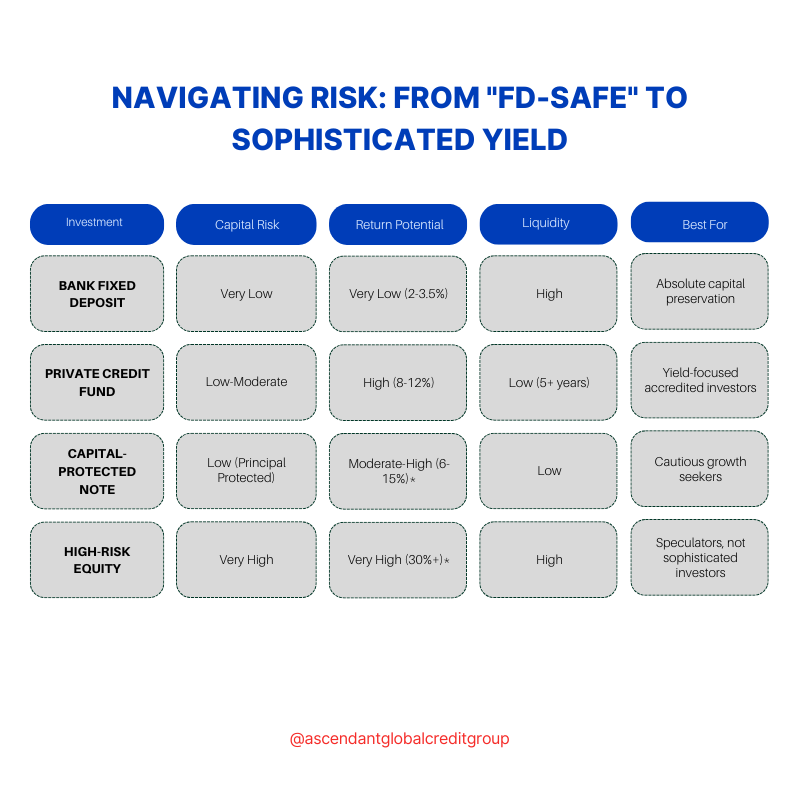

Navigating Risk: From "FD-Safe" to Sophisticated Yield

The journey from FD to alternatives is a journey up the capital stack and risk spectrum.

*Note: While "high-risk, high-reward stocks for 2025" or venture capital can deliver 30%+ returns, they fall under high-risk investments examples with a very different risk profile than income-focused FD alternatives. They are not a direct substitute.*

Conclusion: Your Capital Deserves a Strategic Assignment

Moving beyond fixed deposits is not about abandoning safety; it's about redefining it. For the sophisticated investor, safety means preserving purchasing power and achieving target returns that meet life goals—something a sub-inflation FD cannot do.

The alternatives exist within a structured ecosystem of private debt and real assets. Accessing them requires expertise, due diligence, and often, the guidance of a strategic introducer to navigate the landscape beyond the public banking window.

Ready to strategically reassign your capital?

-

For a sophisticated investor, the best alternative is private credit. It most directly replaces the "lending for interest" function of a bank FD but at a much higher yield, with the trade-off being reduced liquidity. For those not accredited, Singapore Government Securities (T-bills, SSBs) are the safest next step.

-

No reputable bank in Singapore offers 9.5% on a standard fixed deposit. Rates that high are typically found in high-risk investment categories, unsecured corporate bonds of distressed companies, or represent promotional rates for very small amounts with strict conditions. A sustainable 7-10% yield is achievable through private market lending, not traditional FDs.

-

Assets that provide a combination of higher yield, inflation protection, and/or capital appreciation potential are better for long-term wealth. This includes private credit, real asset debt, and selectively, structured notes—all of which require more sophistication than simply walking into a bank.

-

High return investment meaning is relative. Compared to an FD returning 3%, a private credit fund at 9% is a high-return investment. True high-risk investment returns percentage (30%+) involves equity risk (startups, public growth stocks). The key is to distinguish between leveraged yield (private credit) and speculative growth (venture capital).