A Step-by-Step Guide to Building a Multi-Asset Class Portfolio in Singapore

Building wealth in Singapore requires more than stock picking or putting money in fixed deposits. It requires a strategic architecture or Multi-Asset Class Portfolio which smartly distributes the capital for investing in various types of investments to balance growth, income and risk. For Singaporean investors trying to enter the world's volatile markets, opportunities in the region, and specific tax structures such as the SRS, this systematic approach is not just a smart idea, it is a necessary one.

This guide offers a simple and practical structured framework to build a portfolio to develop a growth-focused and resilient one in Singapore's unique financial landscape.

Why a Multi-Asset Class Portfolio? The Singaporean Context

Singapore's status as a global financial hub allows it to have access like no other - but it has also exposed investors to complex cross-currents: US interest rates, the growth of the rest of the Asia-Pacific region, local property cycles, and currency fluctuations. A portfolio that is concentrated in one class of assets (such as only Singapore bank stocks or overseas property) is dangerously vulnerable.

A multi-asset approach provides:

Diversification: Reduces risk by ensuring not all assets move in sync.

Resilience: Shields against local or sector-specific downturns.

Opportunity Capture: Positions you to benefit from growth across geographies and sectors.

Income Stability: Combines growth and yield assets for consistent cash flow.

The 5-Step Framework to Build Your Portfolio

Step 1: Foundation & Self-Assessment

Before investing a single dollar, define your parameters.

Investment Horizon: Is this for retirement in 20 years (long-term) or a property downpayment in 5 years (medium-term)?

Risk Tolerance: Can you stomach a 20% portfolio drop without selling? Be honest.

Financial Goals: Quantify them. "Retire comfortably" becomes "Generate SGD $8,000/month passive income by age 60."

Singapore-Specific Factors: Are you maximizing your SRS contribution for tax relief? Do you have an emergency fund in a high-yield SGD savings account?

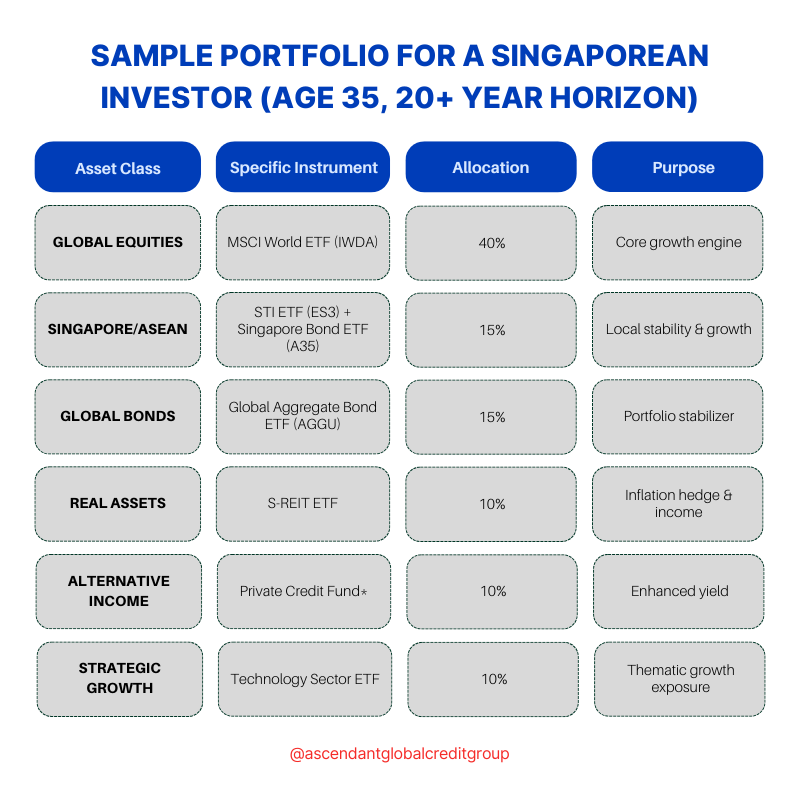

Step 2: The Core Allocation (The 70% Anchor)

This is your portfolio's bedrock—low-cost, diversified, and focused on long-term growth.

Global Equities (40-50%): Gain exposure to the world economy.

Tool: A low-cost ETF like the CSPX (S&P 500) or IWDA (MSCI World).

Singapore Angle: Use your SRS to purchase these for tax-deferred growth.

Singapore & ASEAN Assets (15-20%): Anchor your portfolio to local and regional growth.

Tools: Singapore Government Securities (SGS bonds) for safety, a Singapore/ASEAN ETF (e.g., ES3 for STI, A35 for Singapore bonds), and select blue-chip stocks or REITs.

Purpose: Provides stability, SGD-denominated income, and captures regional demographic growth.

Global Bonds (10-15%): For stability and income.

Tool: A global aggregate bond ETF (e.g., AGGU).

Note: In a rising rate environment, keep duration short.

Step 3: The Satellite Allocation (The 30% Engine)

This is where you enhance returns and add true diversification. This is the domain of the sophisticated investor.

Real Assets (10%): Hedge against inflation.

Options: Singapore REITs (S-REITs), physical gold or gold ETFs, or global infrastructure funds.

Singapore Advantage: S-REITs offer high, tax-efficient dividends.

Alternative Income (10%): Seek higher yield.

Options: Private credit funds (for accredited investors), business development companies (BDCs), or higher-yielding corporate bond funds.

Potential: This is where you target yields of 6-10%+ to replace the function of low-yield fixed deposits.

Strategic Growth & Diversifiers (10%): Target specific opportunities.

Options: A technology sector ETF, a venture capital fund (for accredited investors), or structured notes with capital protection for defined outcomes.

Purpose: Tactical allocations to themes you believe in (e.g., AI, decarbonisation).

Step 4: Implementation & Platform Selection

Choose Your Broker: Select a platform offering access to global markets and local products. Consider fee structures.

Execute with Discipline: Use a dollar-cost averaging (DCA) approach for your core equity allocation to mitigate timing risk. Invest your core allocation first.

Tax Efficiency: Place assets in the right "buckets." Hold high-dividend assets (like REITs) in your SRS for tax deferral. Keep growth-oriented, low-dividend assets in your cash account.

Step 5: Monitoring, Rebalancing & Evolution

Review Quarterly: Check portfolio performance against benchmarks, not daily market noise.

Rebalance Annually: If your 40% equity allocation grows to 50% due to a bull market, sell some to buy underweighted assets (like bonds). This enforces "buy low, sell high" discipline.

Evolve with Life Stages: Gradually increase bond and income allocations as you near your financial goal (e.g., retirement).

**For Accredited Investors only.

Common Pitfalls for Singapore Investors to Avoid

Home Bias: Overloading on Singapore stocks or property. The local market is less than 1% of global markets.

Changing Strategy Mid-Cycle: Abandoning your equity allocation during a market downturn locks in losses.

Ignoring Currency Risk: Investing heavily in overseas assets without considering SGD-foreign exchange fluctuations.

Overcomplicating Before Mastering Basics: Exploring private equity before fully understanding and owning a core of global ETFs.

Conclusion: Your Blueprint for Lifelong Wealth

Building a multi-asset class portfolio is not a one-time transaction; it's the development of a financial system. By following this step-by-step framework—establishing a robust core, strategically adding satellites, and maintaining discipline—you create a portfolio that is built to grow, withstand volatility, and adapt through every market cycle and life stage.

The greatest advantage a Singaporean investor has is access. From global ETFs to sophisticated private markets, the tools are available. The blueprint is here. The next step is yours.

Ready to architect your portfolio? Ascendant Globalcredit Group offers strategic guidance and access to the alternative income and growth components that can move a sophisticated multi-asset portfolio to the next level.