Distressed Credit in Asia: A Contrarian Opportunity for Patient Capital (2026 Outlook)

Executive Summary: The Asian Distress Cycle Accelerates

As Asia navigates a complex 2026 economic landscape—marked by regional debt maturities, property sector adjustments, and corporate restructuring—a significant opportunity is crystallizing for sophisticated capital.

Distressed credit in Asia represents not merely a niche strategy, but a generational contrarian opportunity for investors with the patience to navigate complexity and the expertise to price dislocated risk.

Unlike traditional private credit focusing on performing loans, this arena targets debt trading at deep discounts due to issuer financial stress, offering the potential for equity-like returns with a secured creditor position.

For family offices and accredited investors, this moment echoes past cycles where patient capital was rewarded handsomely.

However, success demands more than capital; it requires local intelligence, legal acumen, and a disciplined approach to a notoriously opaque market. This analysis examines the 2026 catalysts, structural advantages, and implementation frameworks for accessing this high-conviction, high-complexity asset class.

The 2026 Distress Catalyst Map: Where Opportunity Meets Necessity

1. The Great Refinancing Wall

An estimated $2+ trillion in Asian corporate debt matures between 2025-2027. In a "higher-for-longer" interest rate environment, many issuers—particularly in cyclical sectors—face severe refinancing stress, creating a supply pipeline for distressed opportunities.

2. Property Sector Recalibration

China's prolonged property adjustment, alongside overheated markets in Southeast Asia (Vietnam, Thailand), has created a vast universe of stressed developer debt. Selective opportunities exist in projects with sound underlying assets but capital structure failures.

3. Geopolitical & Supply Chain Realignments

Companies caught in shifting trade patterns or regional tensions may face operational distress, presenting opportunities for creditors to drive restructurings that reposition businesses for new realities.

4. Pandemic-Era Hangover

Legacy weaknesses from COVID-19 disruptions are still materializing in hospitality, retail, and aviation-linked sectors, particularly in tourism-dependent economies like Thailand and Indonesia.

Why Asia? The Structural Case for Contrarian Allocation

Asymmetric Information Advantage

Asian distressed markets remain relatively inefficient compared to the U.S. or Europe. Local knowledge of legal systems, creditor hierarchies, and corporate governance creates a substantial edge for specialized investors—an edge that defines successful contrarian capital strategies.

Favorable Legal Developments

Jurisdictions like Singapore (with its enhanced insolvency framework) and Hong Kong are increasingly creditor-friendly. Meanwhile, mainland China's bankruptcy reforms, while complex, are creating more predictable restructuring pathways.

Demographic & Growth Tailwinds

Even distressed situations often occur within growing economies. A successful restructuring can capture Asia's underlying consumption and urbanization trends, offering a "growth kicker" rarely found in developed market distress.

The Anatomy of a Distressed Credit Opportunity

What is a distressed credit? At its core, distressed credit refers to the debt of companies or entities undergoing financial stress, typically trading at a significant discount to par value (often 50-80 cents on the dollar).

This distress can stem from operational failures, excessive leverage, industry downturns, or liquidity crises. Investors aim to acquire this debt at a discount and realize value through: 1) A turnaround and repayment at par, 2) A restructuring that exchanges debt for equity or new debt with better terms, or 3) Enforcement of security through asset sales.

Key Opportunity Types in 2026:

Special Situations Lending: Providing rescue financing to stressed-but-viable companies.

Secondary Market Purchases: Buying existing bank loans or bonds from sellers seeking liquidity.

Post-Restructuring Equity: Taking control via debt-for-equity swaps in reorganization.

Litigation Financing: Funding creditor recoveries in complex cross-border insolvencies.

Implementing the Strategy: Access Frameworks for Accredited Investors

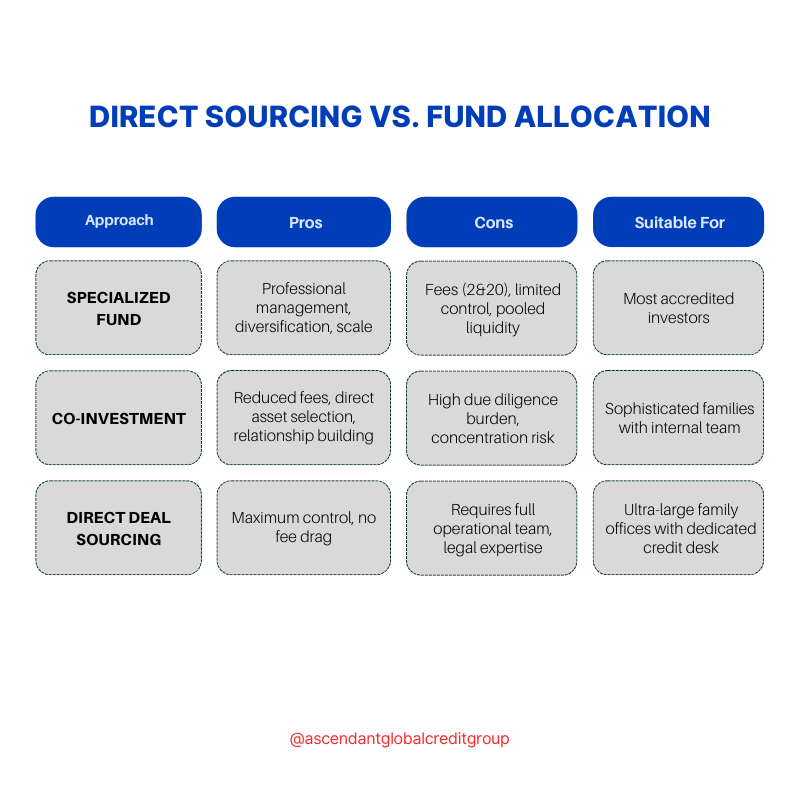

Direct Sourcing vs. Fund Allocation

For most family offices and HNWIs, accessing Asian distressed credit requires partnership:

Due Diligence Imperatives

Local Legal Counsel: Non-negotiable for understanding creditor rights and enforcement.

Asset-Backed Focus: Prioritize situations with hard collateral over pure enterprise value.

Capital Structure Analysis: Identify inter-creditor dynamics—senior secured positions are paramount.

Exit Pathway Validation: Map multiple realistic recovery scenarios before entry.

Risk Framework: Navigating the Contrarian Path

Primary Risks:

Liquidity Risk: Investments are typically locked up for 3-7 years.

Complexity Risk: Restructurings involve multiple stakeholders with conflicting agendas.

Jurisdictional Risk: Recovery outcomes vary dramatically across Asia's legal systems.

Timing Risk: Being too early in a distress cycle requires enduring further mark-to-market pain.

Mitigation Strategies:

Portfolio Construction: 10-15 positions minimum to mitigate single-asset risk.

Sector Diversification: Avoid overconcentration in a single cyclical industry.

Seniority Focus: Prioritize secured over unsecured debt positions.

Partnership Model: Collaborate with local operators and legal experts.

The 2026 Outlook: A Window of Strategic Patience

Current market conditions suggest a multi-year opportunity window for distressed credit in Asia. Unlike the rapid V-shaped recoveries of traded markets, corporate restructurings follow a slower, more judicial timeline—perfectly suited for patient capital with a 5-8 year horizon.

The most compelling narratives are emerging in:

India's post-COVID corporate clean-up

China's property and local government financing vehicle (LGFV) restructurings

Southeast Asia's overleveraged industrial and commodity sectors

Why Invest in Asia Credit? The Macro Perspective

Why invest in Asia credit? Beyond distressed situations, Asia's broader credit universe offers compelling arguments: higher nominal growth rates than developed markets, increasing financial deepening, and a structural shortage of long-term institutional capital. For patient capital, the illiquidity premium in Asian credit—particularly in private and distressed segments—can be substantial. Furthermore, as global portfolios remain underweight Asia relative to its GDP share, strategic allocations here offer valuable diversification and exposure to the world's most dynamic economic region.

Strategic Access for Accredited Investors

For Singapore-based family offices and accredited investors, navigating this landscape requires a structured approach. Ascendant Globalcredit Group serves as an introducer to specialized fund managers and direct opportunities in Asian private and distressed credit. Our role focuses on:

Manager Diligence: Identifying firms with proven local sourcing, legal, and restructuring capabilities.

Opportunity Sourcing: Facilitating access to curated co-investments and specialized fund vehicles.

Structural Navigation: Helping investors understand the legal, tax, and liquidity parameters of these complex allocations.

The contrarian opportunity in Asian distressed credit is real, but it is not for the faint of heart or short of horizon. It is a realm where patience, precision, and partnership determine outcomes.

Frequently Asked Questions (FAQs)

-

As defined earlier, distressed credit refers to debt instruments (bonds, loans, trade claims) of companies or entities facing financial hardship, typically trading at a deep discount due to perceived high risk of default or restructuring. Investors specialize in analyzing, acquiring, and actively working to realize value from these situations, often through complex financial and operational restructurings.

-

The Asia Pacific private credit market has grown exponentially, surpassing $100 billion in AUM (Assets Under Management) as of 2025 and is projected to continue rapid expansion. This includes direct lending, special situations, distressed debt, and real estate credit. The market remains fragmented but is maturing quickly, driven by retrenching traditional banks and strong demand for flexible capital from mid-market companies. The distressed credit segment represents a specialized, growing subset of this broader universe.

-

The core thesis rests on three pillars:

1) Yield Premium: Asian credit often offers higher spreads than equivalent-rated debt in developed markets, compensating for perceived (and sometimes real) additional risks.

2) Growth Embedded: Investments are made within the world's fastest-growing economic region, providing tailwinds to recoveries and business performance.

3) Market Inefficiency: Less analyst coverage and capital provider competition can create pricing dislocations for skilled investors. For the patient, sophisticated allocator, this combination can generate attractive risk-adjusted returns uncorrelated to broader public markets.

Are You Searching For?

Distressed credit in asia a contrarian opportunity for patient capital 2022 – Historical analyses from 2022 highlighted early-stage opportunities as pandemic impacts unfolded. The 2026 landscape reflects a more mature cycle with different catalysts, primarily refinancing stress and sectoral adjustments rather than exogenous shocks.

Contrarian Capital – In investment philosophy, "contrarian capital" refers to strategies that intentionally go against prevailing market sentiment. In distressed investing, this means providing liquidity when others are fleeing, demanding higher compensation for complexity others avoid, and seeing value where markets see only risk.

Contrarian Macro Advisors website – Independent research firms and advisors providing macroeconomic insights can be valuable resources for understanding the broader cycles that create distressed opportunities. Investors should seek those with specific Asia expertise and a track record in credit cycles.

Contrarian Capital Management embezzlement – This search term highlights the paramount importance of operational due diligence. When allocating to any specialized manager, investors must verify auditing controls, custody arrangements, and regulatory history. Governance is as critical as investment strategy in niche, illiquid asset classes.

Contrarian funds llc – The legal structure ("LLC," "LP," etc.) of an investment fund provides certain governance and liability characteristics. For U.S.-based investors in Asian strategies, offshore feeder structures (often Cayman Islands) are common. Understanding the legal and tax implications of the fund vehicle is essential.

Contrarian Capital WSO – Forums like Wall Street Oasis (WSO) often contain career-focused discussions about various asset managers. While useful for cultural insights, investment decisions should be based on formal due diligence, track record analysis, and legal documentation review, not anecdotal forum commentary.

Contrarian Capital Management (AUM) – A manager's Assets Under Management (AUM) can indicate scale and experience but is not a sole indicator of quality. In distressed credit, the ability to source and govern complex deals is more crucial than sheer size. Some of the most effective funds operate in a capacity-constrained manner to preserve returns.