Supply Chain Re-alignment: Private Market Investment Opportunities in Vietnam and Thailand

As supply chains remain vulnerable post-disruption, Vietnam and Thailand emerge as top tier destinations. This analysis covers private market entry points, current risks, and why strategic re-alignment is now a financial imperative.

The Infrastructure Gap in ASEAN: An Investment Primer for Singaporean Capital

ASEAN's massive infrastructure gap presents a generational investment opportunity for Singaporean capital. This primer delves into the funding needs, key sectors, strategic advantages for Singapore, and actionable pathways for deploying capital effectively and sustainably.

Investing in Southeast Asia's Digital Economy Through Embedded Finance Platforms

Southeast Asia's digital economy is booming, powered by embedded finance. This guide explores the investment opportunities, risks, and strategic entry points for sophisticated investors and businesses seeking capital.

How Rising US Interest Rates are Creating Private Credit Opportunities in Asia

Higher US interest rates are driving capital dislocation, opening attractive private credit opportunities across Asia for investors seeking yield and diversification.

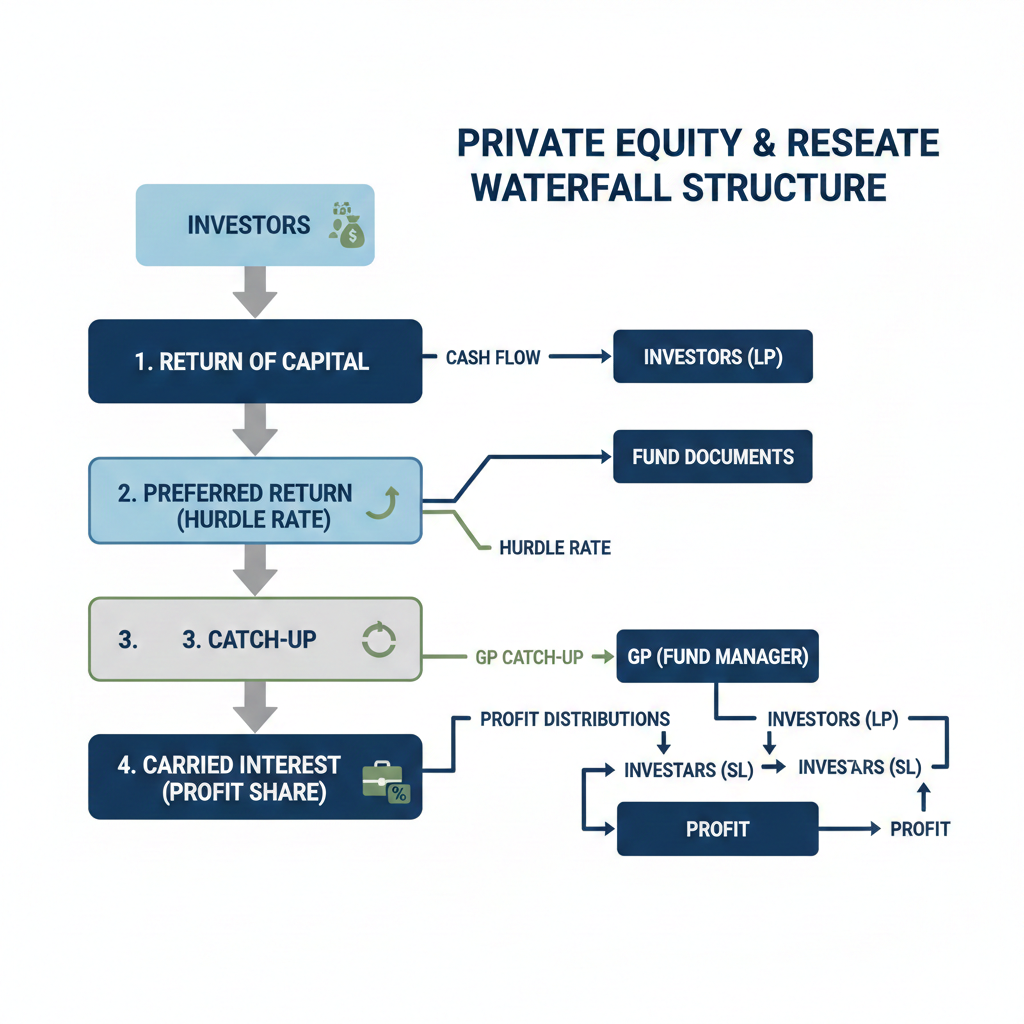

Understanding Waterfall Structures in Private Equity and Real Estate Funds

Understanding Waterfall Structures in Private Equity and Real Estate Funds

How to Analyze a Private Real Estate Debt Deal Memo: A Step-by-Step Guide

Analyze a Private Real Estate Debt Deal Memo: Step-by-Step Guide, How to Analyze a Private Real Estate Debt Deal Memo: A Step-by-Step Guide

The Due Diligence Checklist for Investing in Digital Security Tokens: A 2026 Guide for Sophisticated Investors

Investing in digital security tokens requires rigorous due diligence. This 2026 checklist covers 40+ essential checks across legal, technical, financial, and operational dimensions for sophisticated investors.

How Tokenization is Democratizing Access to Prime Real Estate: A 2026 Investor's Guide

Tokenization is transforming real estate investing, allowing fractional ownership of luxury properties previously accessible only to ultra-high-net-worth investors. This 2026 guide explains the technology, opportunities, and regulatory landscape shaping this revolution.

A Practical Guide to ESG-Linked Loans and Their Financial Returns: A 2026 Analysis for Impact-Focused Investors

ESG-linked loans are transforming corporate finance, offering both sustainability impact and financial returns. This 2026 guide reveals how they work, who benefits, and the measurable returns they deliver.

Investing in Venture Debt: The Secret Weapon for Yield in a Tech Portfolio (2026 Analysis)

As tech valuations stabilize in 2026, venture debt emerges as a strategic yield enhancer for sophisticated portfolios. Explore how this non-dilutive financing tool offers equity-like returns with lower volatility.

Distressed Credit in Asia: A Contrarian Opportunity for Patient Capital (2026 Outlook)

Amidst economic transitions and corporate restructuring, Asian distressed credit emerges as a compelling 2026 contrarian play for investors with patient capital and specialized insight.

The Truth About Capital Protection in Structured Notes: A 2026 Analysis for Accredited Investors

Uncovering the reality behind "capital protected" structured notes in 2026's volatile market. What every accredited investor must know about issuer risk & liquidity traps.

Structured Notes for HNWIs: Balancing Yield and Capital Protection in 2026

In an era of market uncertainty and shifting interest rates, High-Net-Worth Investors are turning to structured notes. This 2026 guide explores how these sophisticated instruments can offer a compelling balance of defined capital protection and enhanced yield potential.

How to Invest in Venture Capital in Singapore Without Going Through Banks

Singapore business ecosystem has been a rich mine of opportunities when it comes to wealth management. Yet this is a bitter reality: the majority of citizens expect that they must have banks in order to embark on investing in venture capital. The reality? You don’t.