The Family Office Guide to Liquidity Management and Private Credit in 2026

For single and multi-family offices in Singapore and Southeast Asia, 2026 will involve a dual mandate: achieve attractive risk-adjusted returns without sacrificing liquidity for strategic purposes - in order to both take advantage of opportunities and satisfy obligations. The conventional weaponry, cash, public equities and government bonds, isn't enough anymore. This guide presents a modern framework for family offices to optimize their liquidity strategy whilst accessing the superior yield and diversification of private credit, the defining asset class for sophisticated capital in the coming year.

The 2026 Liquidity Conundrum for Family Offices

Family offices face unique liquidity pressures that differ from institutional funds or individual investors:

Unpredictable Capital Calls: For lifestyle, philanthropy, and next-generation needs.

Opportunistic Deals: Sudden access to co-investments, distressed assets, or strategic acquisitions.

Portfolio Rebalancing: The need to adjust allocations amid volatile public markets.

Regulatory & Tax Obligations: Timely payments across multiple jurisdictions.

The old model of holding too much low-yield cash poses a huge drag on performance. The new model calls for a tiered liquidity approach coupled with strategic allocation to private credit as an essential part of the liquidity solution itself.

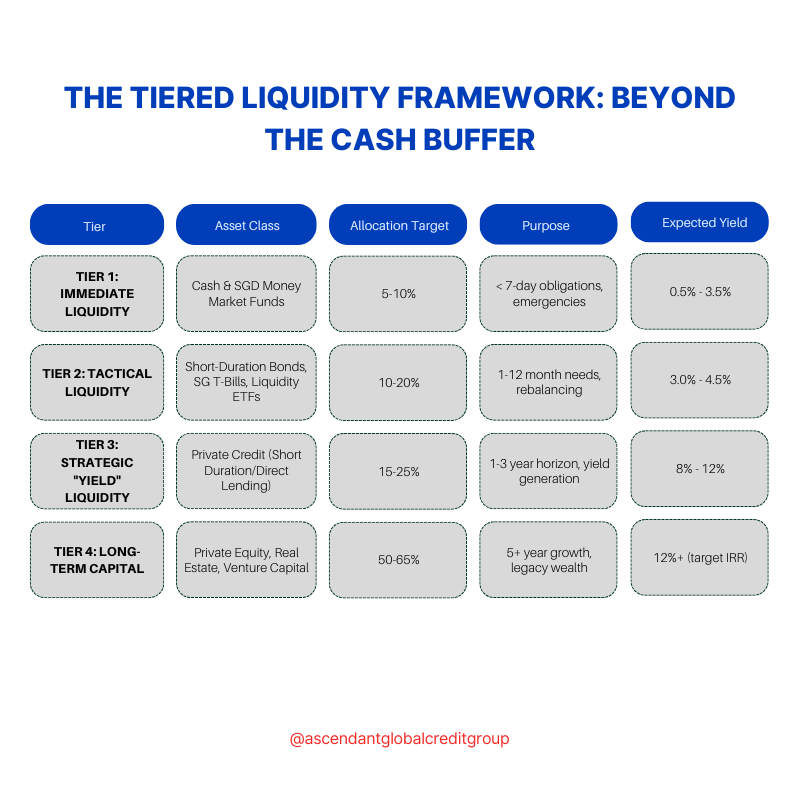

The Tiered Liquidity Framework: Beyond the Cash Buffer

The Paradigm Shift: Tier 3 redefines "liquidity." It is not idle cash, but capital deployed in short-to-medium duration private credit that provides substantial yield while maturing in a predictable, laddered fashion to fund future Tier 1 and 2 needs.

Why Private Credit is the Cornerstone of Modern Liquidity Management

Private credit is no longer just a high-yield satellite allocation. For 2026, it serves a critical strategic function in the family office portfolio.

1. Predictable Cash Flow Engine

Unlike equity, private credit creates contractual and periodic income (quarter or monthly coupons). This predictable cash flow can be smoothed more directly into operating expenses, philanthropic distributions, or tax liabilities which makes significant cash balances that are sitting around, doing nothing more productive impermissible.

2. Defined Maturity Laddering

By building a portfolio of private credit funds and direct loans with staggered maturities (e.g., 1, 2, and 3-year term loans), a family office builds a self-funding "liquidity ladder." As each loan matures, principal is returned and may be recycled in new opportunities or used for liquidity needs having earned a premium yield for the return.

3. Low Correlation & Capital Preservation Focus

Senior-secured direct lending is focused on capital preservation and absolute return, and is lowly correlated to the volatility of public equity. This offers portfolio stability, so that the "liquidity" portion of the portfolio isn't itself subject to dramatic mark-to-market losses at a time when capital might be needed.

4. Inflation-Resistant Yields

With so much private credit having floating rate structures (e.g. SORA + spread), returns by nature move upwards in a rising rate environment, preserving the real value of the liquidity pool from inflation - a feature entirely lacking to fixed rate cash deposits.

Building the Private Credit Liquidity Allocation: A Practical Guide

Step 1: Define the Liquidity Bucket Size

Project 24-36 months of expected capital calls and obligations. Allocate 60-70% of this amount to the Tier 3 (Private Credit) Strategic Liquidity bucket.

Step 2: Select the Right Private Credit Strategies

Not all private credit is suitable for a liquidity function. Focus on:

Senior Direct Lending: To established mid-market companies with strong covenants.

Asset-Based Finance: Loans secured against specific, liquid assets.

Short-Duration Credit Funds: Funds with a weighted average life (WAL) of under 3 years.

Avoid: Distressed debt, long-duration infrastructure debt, and mezzanine tranches with equity-like risk for this bucket.

Step 3: Implement Maturity Laddering

Work with your strategic introducer or investment manager to build a portfolio where maturities are evenly distributed across your liquidity horizon.

Example: A S$20M Strategic Liquidity Bucket

S$7M in notes maturing in 12-18 months

S$7M in notes maturing in 18-24 months

S$6M in notes maturing in 24-36 months

Step 4: Integrate with Overall Portfolio Governance

Reporting: Ensure your private credit holdings report on a frequency that matches your liquidity planning cycle (quarterly is standard).

Dashboard: Create a consolidated view showing cash flow projections from coupon payments and principal maturities across all tiers.

Manager Selection: Prioritize fund managers with a transparent track record of on-time exits and capital return.

The Critical Role of the Strategic Introducer

For family offices, building a purpose-driven private credit portfolio is not a passive investment. It requires:

Access to Top-Tier Managers: The best direct lending funds are often closed or have high minimums.

Diligence on Terms & Structure: Ensuring the fund's strategy, fee alignment, and liquidity terms match your liquidity mandate.

Co-Investment Access: For larger offices, direct co-investment in loans can offer greater control over maturity and terms.

Ongoing Monitoring: Independent oversight of the credit manager's performance and adherence to mandate.

This is where a strategic financial introducer provides indispensable value, acting as an extension of the family office's investment team to source, vet, and monitor these critical holdings.

Conclusion: From Cost Center to Performance Engine

In 2026, leading family offices will not view liquidity management as a defensive cost of doing business. By strategically integrating a tiered framework with a core allocation to private credit, the liquidity portfolio transforms into a high-performing, cash-flow-generating engine that sustains the office's operations and fuels its growth ambitions.

The goal is clear: never let capital sit idle. Instead, deploy it with precision—earning premium yields in private credit while maintaining a disciplined, laddered structure that ensures capital is available precisely when the family needs it.

Is your family office's liquidity strategy optimized for 2026? Ascendant Globalcredit Group provides access to family offices in Southeast Asia with exclusive access to curated private credit funds and direct lending opportunities designed to function as a core component of a sophisticated liquidity management framework.

The Core Differentiator: Family Office vs. Wealth Management

What is the difference between wealth management and family office? This is a very important distinction. Wealth management is almost exclusively focused on investment management - that is, building and managing a portfolio.

A family office, whether single or multi, is holistic. It encompasses:

Investment Management (the "wealth management" piece)

Concierge Services (lifestyle management, travel, security)

Legacy & Succession Planning (trusts, governance, family education)

Administrative Oversight (bill paying, philanthropy management, legal coordination)

The benefits of a family office include this integrated approach, which ensures all aspects of the family's wealth and well-being are aligned and professionally managed.

The Asian Context: A Rapidly Evolving Landscape

How many family offices are there in Asia?

The number is growing exponentially and Singapore alone has an estimated 1,500 family offices. This boom is being driven by the creation of new wealth in areas such as China and India, and a strategic reorganization of the more traditional family units in favor of structures that are more professional in nature.

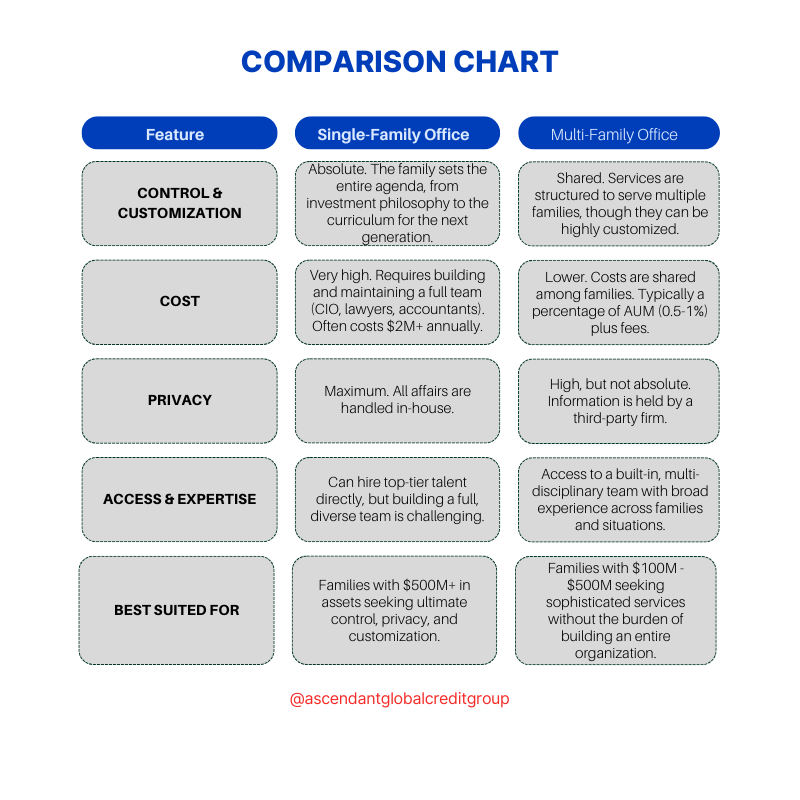

For these families, the tradeoff between an SFO and MFO is very sensitive. An SFO provides for total discretion and thus highly valued. However, an MFO can offer immediate regional expertise and networks that can take a newly created SFO years to develop.

A Third Path: The Outsourced Family Office

Many families find a hybrid model most effective: an outsourced family office or a "virtual" SFO. In this model, the family retains a small core team (often a family member and a trusted advisor) who then outsources investment, legal, and tax functions to best-in-class external providers. This balances control with cost-efficiency and access to top talent.

Conclusion: Making the Right Structural Choice

The decision between an SFO and an MFO is not about which is objectively better, but about which is the right strategic fit for your family's size, complexity, and values.

Choose a Single-Family Office if your priority is maximum control, privacy, and you have the scale to justify the operational burden and cost.

Choose a Multi-Family Office if you seek comprehensive services, institutional access, and shared expertise, while avoiding the complexity of building your own organization.

For many, the journey begins with an MFO or an outsourced family office, evolving into an SFO as assets grow and family needs become more distinct.

At Ascendant Globalcredit Group, we connect families to expert advisors who specialize in this foundational decision. Through our curated network, we facilitate introductions to seasoned consultants who provide unbiased guidance on structuring a family office that aligns with your long-term vision for legacy and impact.

Facing this critical decision for your family's future? Contact us to be introduced to expert advisors who can explore the optimal structure for your unique needs.