Is Your Portfolio Too Heavy on Stocks? The Case for Private Market Diversification in 2026

For decades, the classic 60/40 portfolio—60% stocks and 40% bonds—was the gold standard for investors. But in today's interconnected global economy, public markets are more volatile and correlated than ever. If your portfolio is predominantly made up of publicly traded stocks and bonds, you may be carrying more risk and missing more opportunity than you realize.

The most sophisticated investors have already made their move. According to the McKinsey Global Private Markets Review 2025, global private equity Assets Under Management (AUM) have surged past $13 trillion, demonstrating a massive, strategic shift away from purely public market exposure.

This guide will make the compelling case for why private market diversification is no longer a luxury for the ultra-wealthy, but a strategic necessity for any serious investor looking to build a resilient portfolio in 2026 and beyond.

The Problem: The Illusion of Diversification in Public Markets

You might own ETFs tracking the S&P 500, a few tech stocks, and some international shares. While this feels diversified, these assets are all subject to the same macroeconomic winds—interest rate announcements, geopolitical tensions, and algorithmic trading—that drive short-term volatility.

This high correlation means that during a market downturn, your carefully selected stocks often fall in unison, offering little true protection. This is the fundamental weakness of an all-public portfolio.

What is the 70/30 Rule?

You may have heard of Warren Buffett's 90/10 rule (90% in a low-cost S&P 500 index fund, 10% in short-term government bonds). A common variation is a 70/30 stock/bond split. While these are simple starting points, they are inherently limited because both components are publicly traded and vulnerable to the same systemic risks.

The Solution: Introducing True Diversification with Private Markets

Private markets encompass investments not listed on public exchanges. This includes private equity (ownership in private companies), private credit (direct lending to companies), private real estate, and more.

The benefits of adding this asset class are profound:

Low Correlation to Public Markets: Private assets aren't priced by the minute based on market sentiment. Their value is tied to the underlying company's fundamental performance, providing a crucial buffer against stock market swings.

The Illiquidity Premium: Because capital is locked up for longer periods, investors are compensated with potentially higher returns. This is a key driver behind the strong private equity outlook for 2026.

Access to High-Growth Companies: The most dynamic companies are staying private for longer. By the time a company IPOs, the period of its highest growth has often already occurred in the private markets.

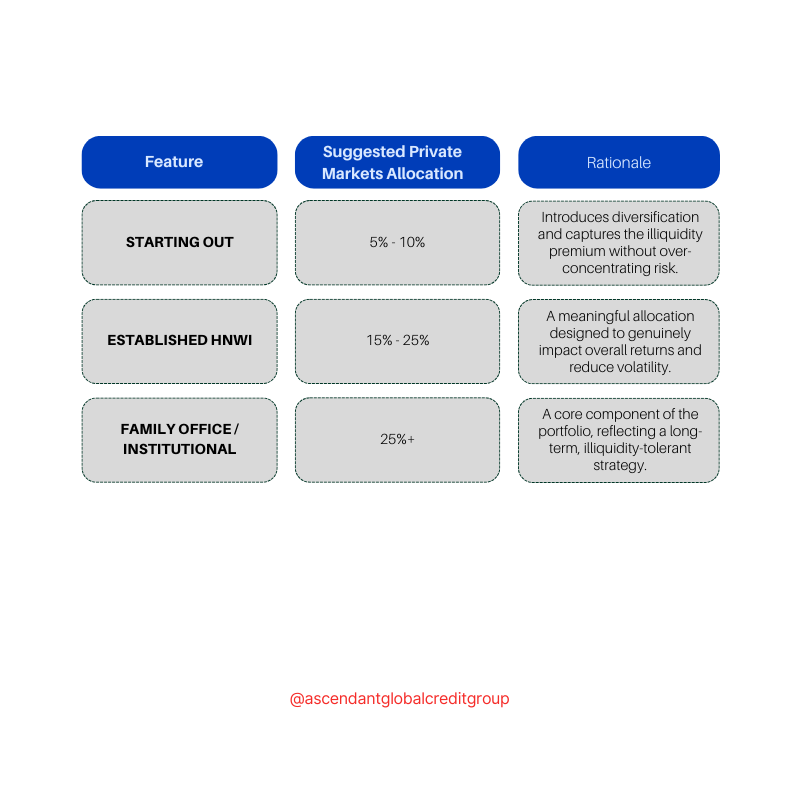

How Much of Your Portfolio Should Be in Private Markets?

There's no one-size-fits-all answer, but for accredited investors, a strategic allocation can significantly enhance portfolio performance.

The goal is not to replace public stocks, but to complement them. A core-satellite approach, with private markets as a strategic "satellite," is the most effective method for most investors.

Navigating the 2026 Landscape: Key Trends to Watch

The private markets outlook for 2025/2026 is shaped by several powerful trends, as highlighted in leading industry reports like the McKinsey Global Private Markets Review and other global private markets reports:

Private Credit's Rise: With traditional banks pulling back, direct lending by private funds is booming, offering attractive, floating-rate yields.

ESG Integration: Sustainable investing is becoming a baseline requirement, not a niche, creating new opportunities in impact-focused private equity and credit.

Secondaries Market Growth: The market for buying existing stakes in private funds is maturing, providing investors with enhanced liquidity options.

Conclusion: It's Time to Rebalance Your Future

Relying solely on public stocks in 2026 is a strategy rooted in the past. The data is clear: to build a portfolio that is truly resilient, diversified, and positioned for superior risk-adjusted returns, an allocation to private markets is essential.

The complexity of this asset class—from sourcing top-tier funds to conducting rigorous due diligence—is why sophisticated investors partner with a strategic introducer.

Ready to rebalance your portfolio for the future?

Ascendant Global Credit Group provides accredited investors with curated access to exclusive private equity and private credit funds.

-

Yes, this is known as "diworsification." Holding hundreds of stocks through multiple ETFs doesn't necessarily protect you from a broad market crash. True diversification comes from adding asset classes with low correlation—like private credit or real estate—that don't move in lockstep with your stocks.

-

While stock market predictions for 2026 foresee continued volatility due to geopolitical and economic uncertainty, the private equity outlook for 2026 remains robust. The consensus is that private markets will continue to offer attractive returns and diversification benefits, particularly in sectors like technology, healthcare, and sustainable infrastructure.

-

For accredited investors, a typical allocation ranges from 10% to 25%, depending on your risk tolerance, investment horizon, and liquidity needs. It's crucial to consult with a financial advisor or strategic introducer to determine the right amount for your specific situation.

-

Warren Buffett's famous rule is actually a 90/10 allocation for his estate. A 70/30 rule is a common adaptation, suggesting 70% in stocks (or equity funds) and 30% in bonds. While simple, this rule is confined to public markets and misses the powerful diversification and return potential of private assets, which are a key part of modern institutional portfolios.