Single-Family Office vs. MFO: A Strategic Guide for Ultra-High-Net-Worth Families in Asia

Asia is experiencing the unprecedented generation of private wealth. Along with this growth comes a complex, defining question for founding patriarchs, matriarchs and their successors: How do we organize our affairs so that our legacy can be maintained and thrive over the generations?

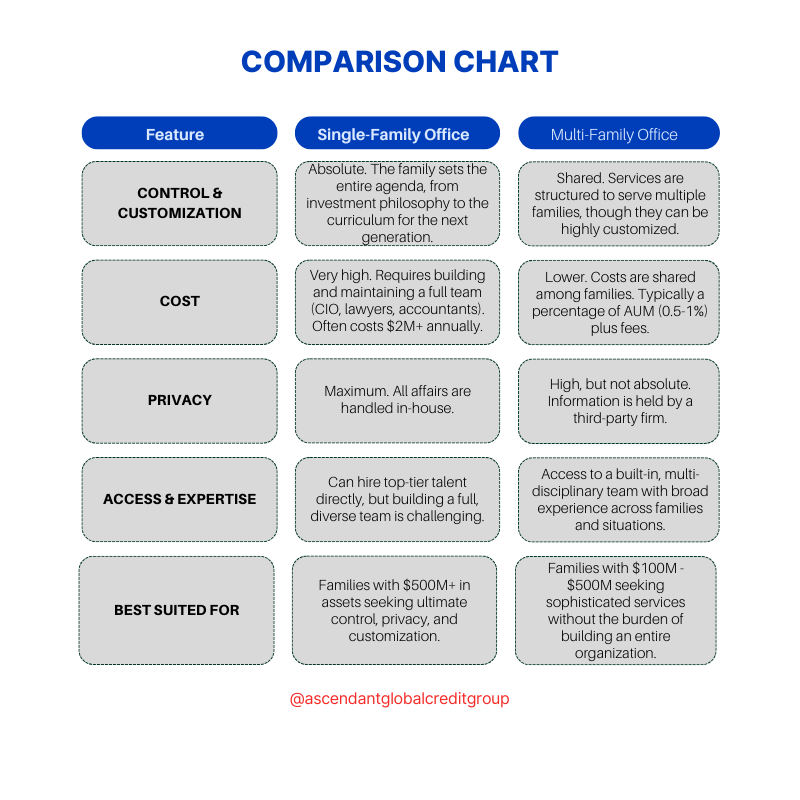

The options tend to boil down to two main types of structures, the custom-built Single-Family Office (SFO) or the collaborative Multi-Family Office (MFO). This is not just some administrative preference; it is a strategic one, when it comes to everything from investment performance to family harmony to privacy and cost. For ultra-high net worth Asian families at this crossroad, this guide gives the necessary framework for decision-making.

Defining the Models and the Ultra-High-Net-Worth Distinction

What is the difference between a single family office and a multi-family office?

A Single-Family Office (SFO) is a private organization that administers the financial and personal affairs of a single family ultra-high-net-worth family. It is an extension of the family and built only for its needs.

A Multi-Family Office (MFO) is a firm that offers family office services to several families. It pools the resources of multiple clients so as to make available services that may be cost prohibitive to clients on their own.

What is considered an ultra-high-net-worth family?

While there are a variety of definitions, an ultra-high-net-worth family usually has investable assets of over $100 million to $250 million. This level of Financial introduces complexity that standard private banking is not able to process, and a separate approach is required.

The Strategic Comparison: Control vs. Cost

The Core Differentiator: Family Office vs. Wealth Management

What is the difference between wealth management and family office? This is a very important distinction. Wealth management is almost exclusively focused on investment management - that is, building and managing a portfolio.

A family office, whether single or multi, is holistic. It encompasses:

Investment Management (the "wealth management" piece)

Concierge Services (lifestyle management, travel, security)

Legacy & Succession Planning (trusts, governance, family education)

Administrative Oversight (bill paying, philanthropy management, legal coordination)

The benefits of a family office include this integrated approach, which ensures all aspects of the family's wealth and well-being are aligned and professionally managed.

The Asian Context: A Rapidly Evolving Landscape

How many family offices are there in Asia?

The number is growing exponentially and Singapore alone has an estimated 1,500 family offices. This boom is being driven by the creation of new wealth in areas such as China and India, and a strategic reorganization of the more traditional family units in favor of structures that are more professional in nature.

For these families, the tradeoff between an SFO and MFO is very sensitive. An SFO provides for total discretion and thus highly valued. However, an MFO can offer immediate regional expertise and networks that can take a newly created SFO years to develop.

A Third Path: The Outsourced Family Office

Many families find a hybrid model most effective: an outsourced family office or a "virtual" SFO. In this model, the family retains a small core team (often a family member and a trusted advisor) who then outsources investment, legal, and tax functions to best-in-class external providers. This balances control with cost-efficiency and access to top talent.

Conclusion: Making the Right Structural Choice

The decision between an SFO and an MFO is not about which is objectively better, but about which is the right strategic fit for your family's size, complexity, and values.

Choose a Single-Family Office if your priority is maximum control, privacy, and you have the scale to justify the operational burden and cost.

Choose a Multi-Family Office if you seek comprehensive services, institutional access, and shared expertise, while avoiding the complexity of building your own organization.

For many, the journey begins with an MFO or an outsourced family office, evolving into an SFO as assets grow and family needs become more distinct.

At Ascendant Globalcredit Group, we frequently advise families on this foundational decision. Our deep understanding of private markets and family capital allows us to provide unbiased guidance on structuring a family office that aligns with your long-term vision for legacy and impact.

Facing this critical decision for your family's future? Contact us for a confidential consultation to explore the optimal structure for your unique needs.