Strategic Financial Introductions for Sophisticated Investors in Singapore & Southeast Asia

Access institutional-grade private credit, structured notes, and exclusive real estate deals not found on public markets. For Accredited Investors, HNWIs, and Family Offices.

Beyond Public Markets: The Ascendant Advantage

Today's most compelling opportunities—higher yields, true diversification, and inflation-resistant returns—exist outside the volatility of public stocks and bonds. We bridge the gap.

For Business Owners & SMEs

Business financing without traditional bank collateral

Growth capital and working capital solutions

Corporate advisory for expansion and M&A

For Business Owners & SMEs

Business financing without traditional bank collateral

Growth capital and working capital solutions

Corporate advisory for expansion and M&A

For Accredited Investors & HNWIs

Curated access to private credit funds (8-12% yields)

Bespoke structured notes for capital protection + upside

Exclusive family office services & estate planning

FinTech Awards 2025

Recognized Expertise in Alternative Finance

Featured Insights

What Our Clients Are Saying

Tools for Strategic Decision-Making

Start with Clarity. Use Our Free Financial Calculators.

Investment Growth Calculator → For investors projecting portfolio goals.

Mortgage & Property Valuation Calculator → For real estate buyers and investors.

70-20-10 Rule Money Calculator → For individuals mastering cash flow.

Gold ROI Calculator → For tangible asset investors.

Financial Flash Deals

Looking for long-term, secure returns?

Explore our limited-time alternative to fixed deposits—with guaranteed interest rates and greater flexibility.

✔️ 3-year policy term: Receive guaranteed returns of 4.65% at the end of policy year 3 and potential maturity bonus of up to 0.48% of your single premium

✔️ 4-year policy term: Receive guaranteed returns of 6.76% at the end of policy year 4 and potential maturity bonus of up to 0.64%¹ of your single premium

These rates are guaranteed and available for a limited number of slots only.

Talk to our team today to reserve your slot or learn more.

Mortgage Solutions Singapore: Currently offering the lowest home loan rates at only 1.45%!

Real Estate Services Singapore: Property owners and buyers can buy or sell with confidence. Sell higher, pay less, pay only 1% agent fees!

Retirement Planning Southeast Asia: Retrenchment benefits and monthly passive income will secure your future.

Investment Opportunities Southeast Asia: Exclusive opportunities, up to 19% per annum are waiting to boost your portfolio.

Take charge of your financial future right now!

We will analyze your current portfolios if you want a second opinion. Furthermore, we will search for cheaper alternatives to secure your money in the banks.

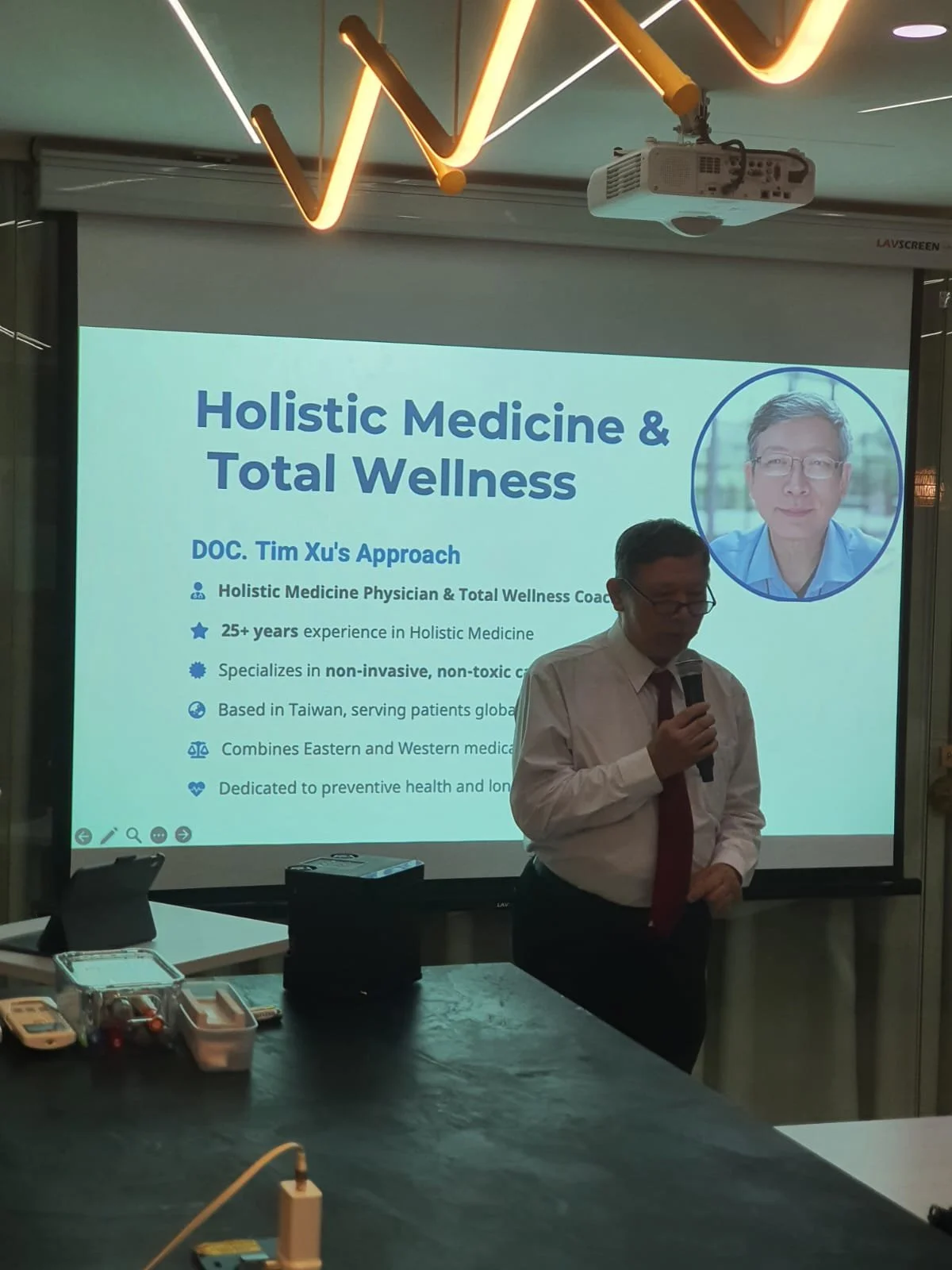

Soft Launch - Integrating Finance & Holistic Wellbeing Gallery

Ascendant’s Investment Risk Profiles Based on Investor Classification

Conservative Investment Allocation

Low-risk strategy with a focus on capital preservation and stable returns.

Moderate Investment Allocation

Balanced strategy combining growth potential with moderate risk exposure.

High-Risk Investment Allocation

Aggressive strategy designed for high growth with higher risk tolerance.

Subscribe to get our Best Fixed Deposit Rates in Singapore eBook

Subscribe to get our Best Fixed Deposit Rates in Singapore eBook

Are you searching for the latest fixed deposit rates in Singapore for your favorite bank?

We at Ascendant Globalcredit Group have researched carefully and contacted several banks in Singapore to get the latest Fixed Deposit Rates in Singapore as of March 2025.

Now whether you’re searching for DBS 1-year fixed deposit rate or UOB fixed deposit rate, you’ll find the complete collection of rates in our eBook “Best Fixed Deposit Rates in Singapore.”

Subscribe here to gain access to our eBook now.

OUR SERVICES

Tailored Financial Introductions

Business Advisory and Strategy

Estate Planning and succession services

Private Family Office Services

Strategic Investment Consulting

Ongoing Support and Management

Your Next Step

Your Access to Institutional Opportunities Begins Here

Whether you're an accredited investor seeking private market yields or a business owner needing strategic capital, our role as your strategic introducer is to perform the rigorous due diligence and open the doors.

Two-Path Conversion Form:

Option A: I am an Accredited Investor / HNWI / Family Office.

I seek private credit or structured note opportunities.

I want to diversify beyond public stocks and bonds.

I need family office or estate planning services.

Option B: I am a Business Owner / Seeking Financing.

I need business or working capital loans.

I am exploring mortgage or real estate financing.

I want a second opinion on my financial strategy.

![How to Calculate Your Readiness for Alternative Investments [Calculator + Guide]](https://images.squarespace-cdn.com/content/v1/66b9cb422cb6fa7aae30d472/1764915527272-RRAK8O84AL41IU5411EW/unsplash-image-lZ_4nPFKcV8.jpg)