3-Year vs 4-Year Policy Term in Singapore: Which Gives Better Returns?

When it comes to saving their money in Singapore, people tend to find themselves at a crossroad:

Should you select a 3-year or a 4-year term policy?

Both options sound promising, safe, and guaranteed at the first sight. And here is the real question:

Which is putting more of your cash in your pocket and without unnecessary risks?

This post explains it step by step, using examples and statistics, to piece it all together so you can understand specifically how each plan functions and more importantly which plan may be most suitable to you.

Why Short-Term Endowment Plans Are Trending in Singapore

By 2025 Singaporeans are more careful with their money. High inflation rates, high interest rates and uncertainty about the global markets make people hesitate in agreeing to 10 or 20 years of savings plans.

In contrast, short duration endowments- 3-year and 4-year single premium endowment are becoming popular as they:

Offer guaranteed returns (no sleepless nights over market crashes).

Fit in to short term goals such as wedding, child education, home renovation, etc.

Provide a low-risk alternative compared to stocks or crypto.

However, the decision of 3 years vs 4 years can seem a difficult one to make. Let’s dive into what the numbers actually mean.

Example: How Much Will You Really Get?

Jason and Mei are two friends and each of them invests S$50,000 in a single premium endowment plan.

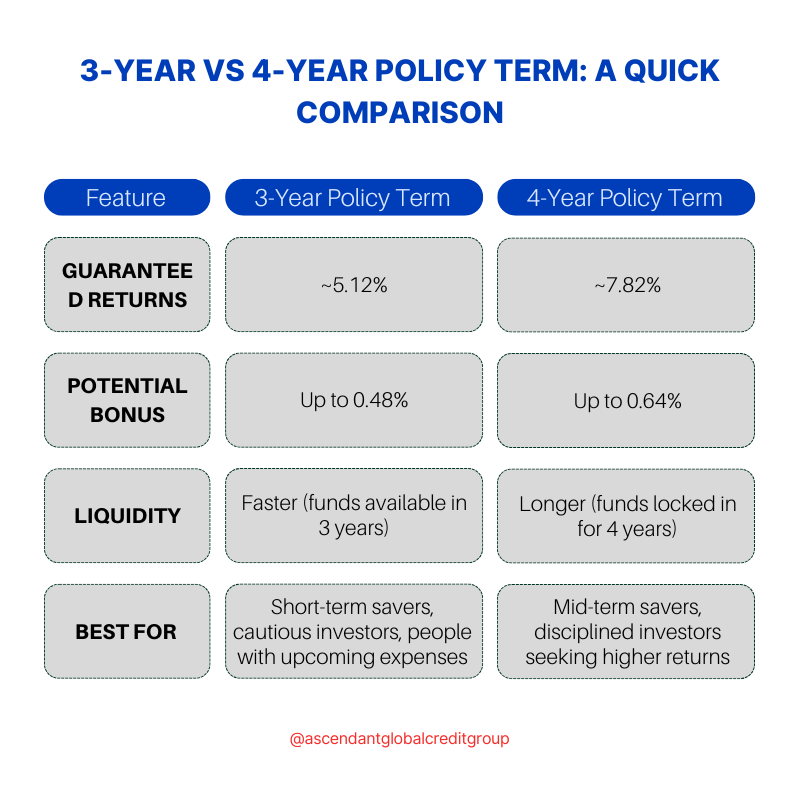

Jason chooses a 3-Year Policy Term.

At the end of 3 years, he receives guaranteed returns of 5.12%.

That’s about $2,560 guaranteed, plus a potential bonus of up to 0.48% (≈ $240).

Total possible returns: $2,800.

Mei chooses a 4-Year Policy Term.

At the end of 4 years, she receives guaranteed returns of 7.82%.

That’s about $3,910 guaranteed, plus a potential bonus of up to 0.64% (≈ $320).

Total possible returns: $4,230.

Now, the question is — who’s the smarter saver?

What should appear on the surface, however, is that Mei earns more due to waiting an additional year. Jason receives his money back sooner, and has the option of reinvesting, spending, or reallocating.

This is where psychology comes into play:

Do you prefer faster liquidity (3 years)?

Or are you willing to lock up funds a bit longer for higher returns (4 years)?

The Psychological Side of Investing

Money decisions aren’t just about math — they’re about mindset.

It you are someone who is always anxious about emergencies then 3 year term is more secure.

And as a person who likes to maximize returns without putting the hands on the money, the 4-year term will be much more rewarding.

That is precisely why no one plan is best. It depends on the needs of your business. The right option would depend on your life stage, financial objectives and risk tolerance.

What About Other Short-Term Endowment Options?

In Singapore, there are multiple short-term options available:

1-year single premium endowment plans — perfect for ultra-cautious savers, but usually offer lower returns.

2-year single premium endowment plans — slightly better returns than 1-year, with manageable lock-in.

3-year and 4-year endowment plans — currently the sweet spot for balancing safety + returns.

Many savers also compare:

Aviva 3-year single premium endowment plan

Tiq 3-year endowment plan

OCBC 2-year endowment plan

NTUC 3-year saving plan

However, this is the catch: although two products may sound similar on paper, the returns, conditions and hidden clauses are different. This is why accessing a bank web site directly is deceptive. Having a financial introducer explain your options ensures you’re not locked into a plan that looks good on paper but doesn’t serve your real needs.

Which Should YOU Choose?

Ask yourself these 3 questions before deciding:

Do I need access to my money in the next 3 years? If yes → 3-year term.

Am I saving for something 4–5 years away? If yes → 4-year term.

Do I value flexibility over slightly higher returns? If yes → 3-year term again.

Remember, both are low-risk, guaranteed-return plans, so you won’t lose — the question is simply how much time you’re willing to commit.

Key Takeaway

3-Year Policy Term: Faster payout, lower but decent returns, better for cautious savers.

4-Year Policy Term: Slightly longer wait, but significantly higher guaranteed returns.

In short, there’s no “wrong” choice — only the choice that fits your personal goals, lifestyle, and comfort with waiting.

If you’re unsure, this is exactly where we come in. As financial introducers, we help you cut through the noise, compare the real numbers, and choose a plan that truly matches your goals.

-

Fixed deposits and short-term endowment plans are among the safest. While fixed deposits offer low but guaranteed returns, endowment plans typically give higher guaranteed payouts within 3–4 years, making them a strong choice for cautious investors.

-

The best short-term endowment plan in Singapore is usually a 3-year single premium endowment that guarantees 5%+ returns with optional bonuses. However, suitability depends on your personal needs and upcoming expenses.

-

You can invest $10,000 in short-term endowment plans, fixed deposits, or low-risk savings policies. For example, putting $10,000 in a 3-year endowment plan can give you guaranteed returns while keeping your money safe.

-

A 2-year plan provides faster liquidity but usually lower returns. A 4-year plan locks your money slightly longer but offers higher guaranteed returns (up to 7.82%), making it more rewarding if you can wait.